The Nature Scorecard

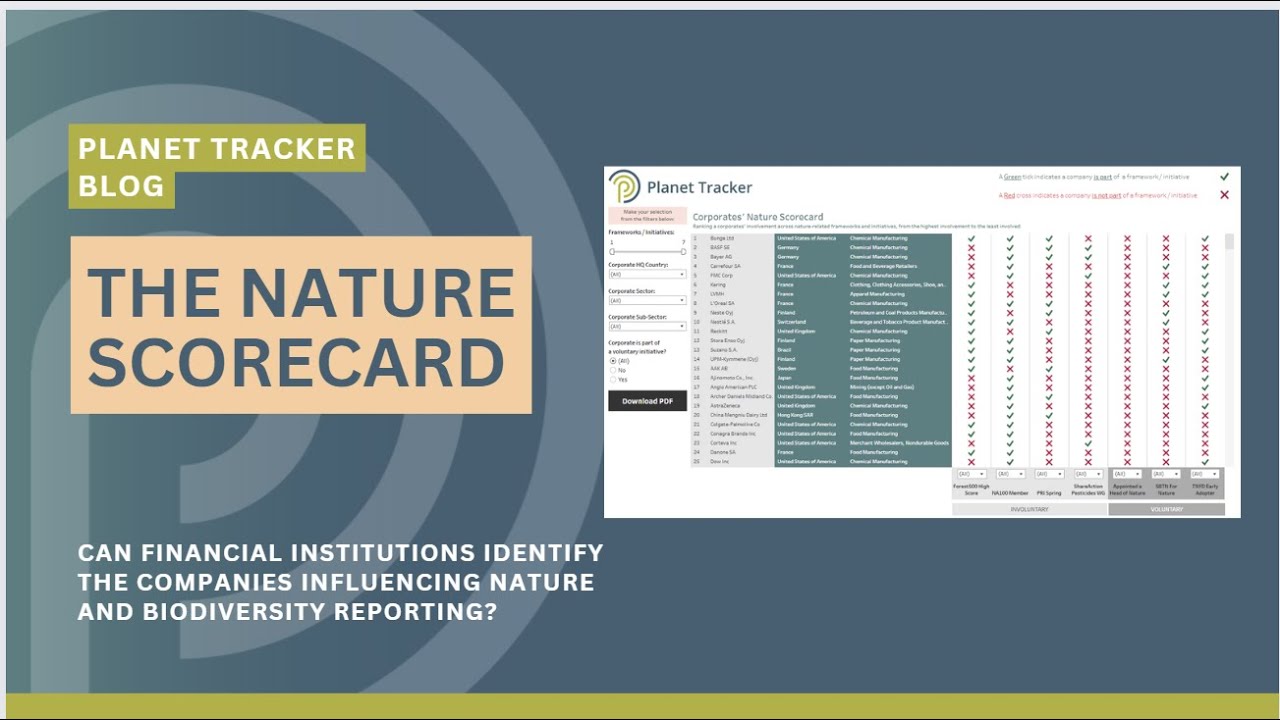

As corporates prepare themselves for nature and biodiversity reporting, are financial institutions able to identify those companies which are more influential? Some corporates were pulled into the spotlight by being named as focus companies by the Nature Action 100 initiative and the PRI Spring Initiative, whether they liked it or not. Others have demonstrated a willingness to voluntarily sign up to nature initiatives such as the early adopters of the TNFD, especially those for 2024 or earlier, and those submitting plans to the SBTN. Presently, it’s limited to a select group of corporates. Planet Tracker’s Nature Scorecard shows only one company as a member of 4 nature initiatives and a further 13 in at least three of them. We encourage more corporates to join nature initiatives voluntarily.

Nature’s corporate supporters – whether you like it or not

In November 2022, a global investor engagement initiative, the Nature Action 100,i was launched by 11 investors, known collectively as the Launching Investor Group.ii The aim of the initiative is to engage with key sectors that are ‘systematically important in reversing nature and biodiversity loss by 2030’. See key sectors below. Investors’ expectations include six actions, calling on companies to take related to ambition, assessment, engagement, governance, implementation and targets.iii

Nature Action 100 key sectors

- Biotechnology & pharmaceuticals

- Chemicals (such as agricultural chemicals)

- Consumer goods retail, (including e-commerce and specialty retailers and distributors)

- Food (ranging from meat and dairy producers to processed foods)

- Food & beverage retail

- Forestry & paper (including forest management and pulp and paper products)

- Household & personal goods

- Metals & mining

Source: Nature Action 100

From these eight sectors 100 companies were identified, chosen on factors such as a large market capitalisation, representing both developed and emerging markets, and having a high potential impact on nature. The 100 selected companies may be viewed here. In October 2023, the Principles for Responsible Investment (PRI) launched ‘Spring’,iv its stewardship initiative on nature. Spring establishes a ‘group of investors to use their voice and influence to drive positive outcomes for nature’.v Initially, 131 investors endorsed this initiative, with more expected to join.

As a first step, the PRI decided to focus on forest loss and land degradation as a driver of biodiversity loss. Other drivers are expected to be added in the future. The five main drivers of biodiversity loss are shown below.

Main drivers of biodiversity loss

- Land and sea use change

- Over exploitation of natural resources

- Pollution

- Climate change

- Invasive alien species

Source: Business for Nature – Financial services: Priority actions towards a nature-positive future.vi

The PRI Investor Group members identified 40 companies with which to engage, which will commence in mid-2024. Additional corporates will likely be added later this year. The initial 40 companies may be viewed here and in the Planet Tracker Nature Scorecard.

Six companies make both investor engagement lists although it should be noted that there was never intended to be a significant overlap between the Nature Action 100 and PRI initiatives. Spring’s ‘aim is not to duplicate efforts, but rather to complement existing work by other initiatives’.vii

Companies identified by the Nature Action 100 and PRI Spring Initiative

- Archer Daniels Midland (ADM)

- BASF (BAS)

- Bayer (BAY)

- Bunge (BG)

- China Mengniu Diary (2319)

- L’Oreal (OR)

Source: PRI, Nature Action 100, Planet Tracker.

Also focused on a major driver of both biodiversity and climate change is Global Canopy. For the last 10 years, it has published the Forest 500, an assessment of 500 ‘companies and financial institutions with the greatest links to deforestation, conversion of natural ecosystems and associated human rights abuses’.viii A set of indicators was used to track the progress of a company’s commitments towards addressing deforestation risk with each company given a score out of 5. In 2024, only 15% of companies assessed scored a 3 out of 5 or higher. In our corporate supporters’ dashboard, we highlight those companies. Note that no company was rated 5/5, but eight did achieve 4/5. These were: Amaggi, Mars (MARS), Nestlé (NESN), PepsiCo (PEP), Procter & Gamble (PG), Sipef (SIP), Suzano (SUZ) and Unilever (ULVR).

ShareAction has also targeted an important factor in the biodiversity crisis which affects land-use change and pollution.ix This is why they have created a Pesticides Working Group for investors which targets six companies. Ranked in order of 2022 pesticide sales, starting with the highest, they are: Syngenta (SYENF), Bayer (BAY), BASF (BAS), Corveta (CTVA), FMC Corp. (FMC) and UPL (UPL).x This three-year initiative aims to drive up biodiversity ambition within the six largest pesticide companies. Share Action found that none of these six companies disclosed basic information about their product portfolios, impact assessment methods, or value chains. They also found only two companies assess the impacts of their pesticide products on biodiversity, and only one company has committed to reducing the environmental impact of pesticides. These companies can be found in Nature Scorecard, in the involuntary category. We acknowledge that none have yet been identified as adopting best practice.

Nature’s corporate supporters by choice

As initiatives emerge to assist corporates to make nature-related disclosures, we can identify management teams which are at the forefront of understanding and revealing nature dependencies, impacts, risks, and opportunities.xi

One useful indicator is the Taskforce on Nature-related Financial Disclosures (TNFD) which rolled out the voluntary framework in late 2023xii and asked for early adopters to step forward. 184 organisations indicated a willingness to publish their TNFD disclosure for the 2024 financial year or earlier. A further 135 intend to have this in place for the 2025 financial year. Early adopters may be viewed here.

Of those companies targeted by the Nature Action 100 and PRI, only Bunge [BG] (for the 2024 financial year) is a TNFD early adopter. For the 100 NA companies only, 13 are early adopters: Anglo American (for financial year 2025), Bunge (2024) Carrefour (2024), Dow (2025), FMC Corp (2025), International Paper (2025), Marubeni Corp (2025), Novo Nordisk (2025), Oji Holdings (2024), Smurfit Kappa Group (2025), Stora Enso (2024), Suzano (2025), and Vale (2025). For the PRI Spring companies there are only four companies: Bunge (2024),) JDE Peet (2024), Reckitt (2024).

Another organisation pushing ahead with nature reporting is the Science Based Targets Network (SBTN). In May 2023, it launched “the world’s first science-based targets for nature, a significant milestone towards helping companies take integrated action across freshwater, land, ocean, biodiversity, and climate”.xiii An initial group of seventeen global companies are preparing to submit targets for validation, including AB InBev, Alpro (part of Danone), Bel, Carrefour, Corbion, GSK, H&M Group, Hindustan Zinc Limited, Holcim Group, Kering, L’OCCITANE Group, LVMH, Nestlé, Neste Corporation, Suntory Holdings Limited, Tesco and UPM. Please note that we have excluded SBTN Corporate Engagement Partners from our Scorecard, as they have not made the same level of commitment as the 17 pilot companies.xiv Of these, none are presently part of the PRI Spring Initiative, while four – Carrefour, Danone (through Alpro), Nestlé and UPM – are included in the Nature Action 100.

Planet Tracker also examined corporates making commitments under the Business for Nature initiative, comprising 85 partner organisations.xv The organisation has been encouraging companies to submit their nature strategies under the It’s Now for Nature campaign.xvi The aim of the campaign is to get “businesses and institutions [to] recognise they cannot sustainably grow their business, or achieve their climate goals, without protecting and restoring nature”. It aims for a nature-positive world by 2030. However, to date, Business for Nature has not released details of corporates which have set a nature strategy.

Planet Tracker has not included a separate metric for measuring biodiversity submissions to CDP as the non-profit has announced that it will align with the TNFD framework.xvii CDP will start to reflect this alignment in its disclosure system for 2024. CDP has been collecting data on some nature-related issues for some time, notably for forests and water, but it will soon be adding further environmental metrics. In late 2022, CDP announced that 7,790 companies had responded on biodiversity through its climate change questionnaire, but 55% were failing to act.xviii

Planet Tracker also notes the use of the Global Reporting Initiative (GRI) by corporationsxix. In 2024, GRI updated its biodiversity standards, however, these do not come into effect until January 2026. Therefore it is something to monitor in the future and is not included in the present Nature Scorecard.

One further check which can be undertaken, is whether a corporate has an identifiable executive responsible for nature. For example, among the financial institutions, Lombard Odier appointed a Chief Nature Officer in mid-2023.xx To date, a handful of banks have followed this example such as Lloyds Bank (LLOYD) and NatWest (NWG) which both have a Head of Nature, while Standard Chartered (STAN) has a Head of Biodiversity.xxi xxii Planet Tracker searched Bloomberg, Google and LinkedIn for nature and biodiversity roles and the following five corporates (excluding financial institutions) are identified in our Nature Scoreboard: Arup (engineering consultancy) Baswood Corp. (wastewater management), Bellway [BWY] (construction), Burberry plc [BRBY] (fashion), Geopark Ltd [GPRK] (oil & gas).

The scorecard

Planet Tracker’s Nature Scorecard presently comprises 373 companies. Note that financial institutions such as asset managers and investment banks have been excluded. The Scorecard ranks these corporates by the number of nature initiatives and frameworks of which they are a member, on both a voluntary and involuntary basis.

Of these companies, 138 join the scorecard because of their forced membership of nature initiatives without joining any on a voluntary basis, while the remaining 235 are members of at least one voluntary nature initiative.

The dominant sectors among all these corporates are food manufacturing, chemical manufacturing and professional, scientific & technical services (e.g. ERM, EY, PwC etc.) If you examine those corporates which have not adopted any voluntary action the main sectors are food manufacturing, chemical manufacturing and mining.

Examining the Scorecard by geography we note the dominant countries by domicile (as measured by the location of the corporate headquarters) are Japan, USA and UK. Among those joining on an involuntary basis the dominant countries are USA, Brazil and Indonesia.

Interestingly, among the handful of corporates that have recruited a Head of Nature or equivalent, none have been selected by investors to join an initiative nor have they voluntarily done so.

Only Bunge (BG) is a member of four of the seven initiatives listed in the Scorecard, the highest of any company, of which one is voluntary (as a TNFD early adopter) and three involuntary (Forest 500, Nature Action 100 and PRI Spring). A further thirteen are members of three initiatives but three of these have not signed up for any voluntary measures – BASF (BAS), Bayer (BAY) and L’Oreal (OR). Among this group are three companies that have voluntarily joined two or more initiatives – Carrefour (CA), Kering (KER) and LVMH (MC).

Of these 14 companies, the most prominent sectors are chemical manufacturers (6 companies) and paper manufacturers (3 companies). Geographically, France accounts for 4 of these companies and Finland 3. Only one of these corporates is from the Global South, Suzano (SUZB3) the pulp and paper producer from Brazil.

Closing comments

With the TNFD issuing its final recommendation on nature-related financial disclosures in September 2023, we recognise it is early days for corporates to provide nature-related data. Even the earliest TNFD adopters will not have to publish such disclosures until 2025, for the 2024 financial year. However, companies can no longer claim they lack guidance on nature reporting. Investor initiatives such as the Nature Action 100 and PRI Spring Initiative provide significant opportunities for financial institutions to press companies for progress. The ‘biocrastination’xxiii needs to stop.

ii The 11 investors were: AXA Investment Managers, BNP Paribas Asset Management, Christian Brothers Investment Services, Church Commissioners for England, Columbia Threadneedle Investments, Domini Impact Investments, Federated Hermes Limited, Karner Blue Capital, Robeco, Storebrand Asset Management, and Vancity Investment Management

iii Nature Action 100 – Investor expectations (website accessed 29 February 2024)

iv PRI Spring: A PRI stewardship initiative for nature (website accessed 29 February 2024)

v PRI Spring: Investor statement (February 2024)

vi Business for Nature – Overview – Financial services: Priority actions towards a nature-positive future (September 2023)

vii PRI Spring FAQ (website accessed 26 February 2024)

viii Global Canopy – Forest 500 – A decade of deforestation data: Annual report 2024 (February 2024)

ix ShareAction – A Growing Problem: Why investors must engage with the pesticides industry – media release (March 2023)

x ShareAction – A Growing Problem: Why investors must engage with the pesticides industry – briefing (March 2023)

xi Taskforce on Nature-related Financial Disclosures (TNFD) – (website accessed 29 February 2024)

xii Taskforce on Nature-related Financial Disclosures (TNFD) recommendations (website accessed 29 February 2024)

xiii Science Based Targets Network – Launch of the world’s first science-based targets for nature (May 2023)

xiv Science Based Targets Network – Corporate Engagement Partners (website accessed 26 February)

xv Business for Nature (website accessed 26 February 2024)

xvi Now for Nature (website accessed 26 February 2024)

xvii CDP – CDP announces intention to align with TNFD framework and drive implementation across global economy (September 2023)

xviii CDP – New data shows companies recognising biodiversity risks but majority not turning commitments into action (November 2022)

xix GRI – GRI Community Members (website accessed 28 February 2024)

xx Lombard Odier – Investing in nature, our most precious asset – an interview with Marc Palahì, our Chief Nature Officer (September 2023)

xxi Lloyds Banking Group – What it means to be Head of Nature at Lloyds Banking Group (September 2023)

xxii ESG Today – Standard Chartered Appoints Oliver Withers as First Head of Biodiversity (May 2023)

xxiii Planet Tracker: ‘Biodiversity risk – further delays’ (January 2024)