At the Vanguard of a Sustainability-Driven Disruption

Why should sustainable investors be interested in Vanguard, a USD 8 trillion asset manager, buying Just Invest, which manages a mere USD 1 billion? For three main reasons. One, Vanguard has broken the habit of a lifetime with its first acquisition since its founding in 1975. Two, this acquisition provides Vanguard access to a provider of direct indexing and customisable products company (following in the footsteps of Blackrock, Morgan Stanley, and Charles Schwab). Three, this deal reveals the challenge facing the index majors from the upcoming disruptors. All of this suggests that retail investors are facing a real possibility of customisable sustainable products.

The deal

Vanguard, the second largest investment manager with global assets of USD 7.9 trillion[1] offers over 400 funds to more than 30 million investors worldwide. It has just announced its first acquisition since its founding in 1975. It has made a definitive agreement to acquire Just Invest[2].

Just Invest, founded in 2016, is a provider of tax-managed, tailored wealth management technology, including a highly customizable, direct indexing offer. Just Invest has assets of close to USD 1 billion.

In addition to size and date of founding, the difference between the two organisations is stark: Vanguard is well known for funds that track indices. Just Invest provides tools for investors and advisers to build bespoke portfolios.

Why is this important for sustainable investing?

Clearly Vanguard regards this as an important move choosing Just Invest as its first corporate acquisition since its creation in 1975. Vanguard’s Chairman and CEO justified the purchase by stating that ‘technology-driven solutions such as direct indexing[3] continue to reshape our industry, driving better investment outcomes and lowering costs for clients’[4].

Direct indexing lets investors customise an index to meet specific outcomes, therefore allowing investors to construct an index to meet specific outcomes such as an improved ESG score, lower risk or a reduced tax burden. The Just Invest platform uses sophisticated portfolio management tools traditionally available only to institutional or ultra-high-net-worth investors.

This approach permits a high degree of portfolio customization, providing advisors with the ability to personalise investment portfolios to reflect investors’ values and financial objectives. Sustainable investors should find this news encouraging.

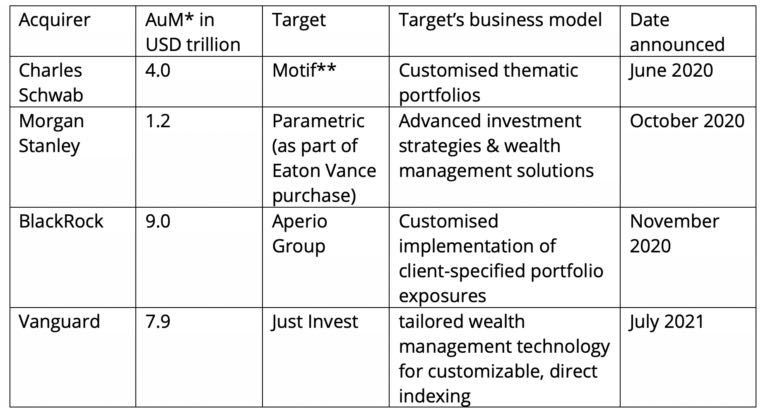

The large investment managers buy into customisation specialists

By undertaking this purchase Vanguard has joined a number of its large competitors by positioning itself to offer a high degree of customisation, but not only for institutions and ultra-high net worth individuals. We have raised the lack of choice for retail investors previously. See ‘Online Retail Investors: Can’t see the wood for the trees’. The die is cast.

*Assets under management

**Technology and intellectual property only

Sources: media reports and Planet Tracker

The involvement of the challengers to the major index providers is interesting to observe in this acquisition. In our recent research paper ‘Indexing: Prepare for Sustainability-Driven Disruption’ we argued that ‘the index production landscape is evolving to meet the demands of sustainability-based investment products. Declining fund fees, rising competition in index production and demand for greater consumer choice have all arrived at the same time as the upswing in sustainable investing’.

In May this year, Just Invest announced that it was switching 15 major benchmarks to Solactive[5], a self-styled ‘industry disruptor’ to offer ‘advisors quality direct indexing constructed with benchmarks comparable to major name-brand indices without major name-brand cost’.[6]

Vanguard has been a longer-term user of a smaller index provider, The Center for Research in Security Prices (CRSP)[7]. Vanguard has a range of funds that track CRSP indices[8]. It moved a number of benchmarks from MSCI to CRSP in 2012.

BlackRock, the world’s largest investment manager, which purchased Aperio late last year, is intending to offer more sustainable investment options ‘through advancements in technology’ and engaging with ‘index providers to develop sustainable versions of their flagship indices’[9]. BlackRock mentioned its work with Qontigo[10] in preparing their portfolios for a net-zero World[11].

The major financial institutions are positioning themselves to offer customisation of investment portfolios to a wider range of clients (beyond select institutions and high net worth individuals. This will be a step change for pension funds and retail investors, giving them the opportunity to align their investments much more closely with their values than is possible at present.

Which of the investment managers will break ranks first?